- Services

Technology Capabilities

Technology Capabilities- Product Strategy & Experience DesignDefine software-driven value chains, create purposeful interactions, and develop new segments and offerings

- Digital Business TransformationAdvance your digital transformation journey.

- Intelligence EngineeringLeverage data and AI to transform products, operations, and outcomes.

- Software Product EngineeringCreate high-value products faster with AI-powered and human-driven engineering.

- Technology ModernizationTackle technology modernization with approaches that reduce risk and maximize impact.

- Embedded Engineering & IT/OT TransformationDevelop embedded software and hardware. Build IoT and IT/OT solutions.

- Industries

- GlobalLogic VelocityAI

- Insights

BlogsGlobalLogicJuly 27, 2023Exploring Snowpark and Streamlit for Data Science

I’m Janki Makwana, a Data Scientist at GlobalLogic. I have been working with a major re...

BlogsJuly 18, 2023Manik Jandial

BlogsJuly 18, 2023Manik JandialView on payment industry modernisation: Enablers of change

Welcome to the second part of our two-part series on the evolving payment industry! In ...

- About

Published on July 18, 2023View on payment industry modernisation: Enablers of change

View all articles Manik JandialShare

Manik JandialShareLet's start engineering impact together

GlobalLogic provides unique experience and expertise at the intersection of data, design, and engineering.

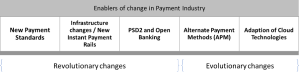

Get in touchFinancial ServicesWelcome to the second part of our two-part series on the evolving payment industry!In part one, we discussed the drivers of change that have shaped the payment landscape. In this continuation, we will dive deeper into the enablers of change and how they are revolutionising the future of payments.

Figure 5: Enablers of change in the payment industry

-

New Payment Standards

Over the last three decades, multiple standards – including proprietary standards used by financial institutions – have caused inefficiency, inconsistency, and a lack of customisation in different geographies and business areas. Examples include ISO 15022 for cross-border settlement, ISO 8583 for credit and debit card settlement, FIX for securities and trade, SWIFT (MT) in banking, and DTCC as an example of market infrastructure using proprietary standards.

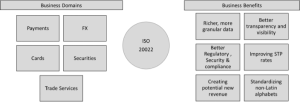

ISO 20022, introduced in 2004, will be the agreed methodology for consistent message standards in the financial industry from 2019 to 2025. It standardises data objects from market infrastructures and offers common terminology for financial institutions.

Figure 6: Benefits of ISO 20022

According TO J.P. Morgan, by 2025, ISO 20022 will be the universal standard for high value payment systems of all reserve currencies, and will support 80% of transaction volumes, plus 87% of transaction value globally.

ISO 20022 can be used as the basis for any business’s internal financial communication – which is often overlooked. After banks and institutions migrate to ISO 20022, the next set of evolutions beyond 2025 will involve changes in internal systems based on the ISO 20022 dictionary.

Businesses must work alongside their enterprise resource planning (ERP) and treasury management system (TMS) provider, along with related system providers, to upgrade to ISO 20022 to ensure they don’t miss out on the growing data-driven payments markets.

-

Payment Rails

Payment rails move funds domestically and internationally. Central banks are transforming national payment rails to keep up with evolving customer needs and advancements in payment technology and data formats.

A report by World Bank Group shows that in 2014 there were only 14 local real-time payment schemes, and currently that number is just over 60; with 20 of those networks launching in the last 18 to 24 months.

Figure 7: Faster payment systems over the years. Source: World bank

This is leading to standardisation and unification of payments processing, meeting the ever-growing need for real-time and instant payment settlement. Details of some of the major real-time systems is as follows:

Figure 8: A look at real-time networks across Europe, UK, US

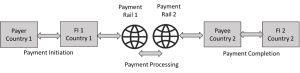

Although interconnecting payment rails will be a challenge, it’s an opportunity to resolve cross-border payment processes. Market infrastructures, like Fedwire and EBA, have conducted Proof of Concept (POC) for cross-network interoperability with ISO 20022, potentially achieving cross-border interoperability without correspondent banks by end of 2023.

Figure 9: Direct connectivity for payment processing instead of correspondent banks

Traditional card networks and domestic payment rails will be challenged to connect ‘open loop’ payments with cross border payment consisting of new payment infrastructure. This challenge will inevitably lead to a surge in innovative solutions across almost all domains and offer an opportunity for businesses to provide better experiences to their consumers and solve multiple customer pain points.

Figure 10: Snapshot of card and real-time payment network ecosystem. Source: Edgar, Dunn & Company

Takeaway:

These rails enable secure, fast and always-on environments. The speed of the payment means they are well suited to supporting innovation and competition by providing a backbone for new digital experiences for all players in the payment’s ecosystem, including consumers, corporates, merchants and governments.

Geographies that have implemented real-time payment rails are witnessing benefits like faster processing and clearing of funds in high-volume and low-value payments. Services such as convenient funds transferred via mobile number, email address or aliases, result in lower processing fees due to common standards. This makes it convenient to do cross-border payments and remittances with reduced fees, speed, and transparency.

Card based networks and real-time rails will co-exist. The industry will see mixed usage of these networks to improve cost and efficiently process transactions as per business needs. Regulators are encouraging usage of multiple networks and rails to bring the cost benefit to consumers.

-

PSD2 and Open Banking

Open banking enables consumers to control their banking data and fosters innovation by allowing third-party products and services to enter the market.

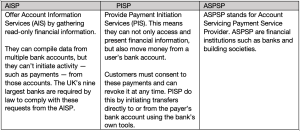

PSD2, a legal framework in Europe and the UK, requires financial institutions to share their customers’ account information with third parties, with the customers’ consent. Banks have complied by digitising their platforms and competing with FinTech’s (AISP, PSP, TPP) to offer innovative payment services. AISPs and PISPs manage customer consents and data processing under GDPR.

Figure 11: Regulated providers that can access bank account with account holders’ permission

Payment services like payment initiation, pay-outs, checking payment transaction history, and checking balance have been created using open banking with strong identity management and authentication methods by various PISPs across industries.

New payment rails have improved payment system connectivity and settlement processes, while PSD2 mandates banks to open their payment infrastructure for businesses to directly interact with customers and build innovative solutions leveraging new payment ecosystems for real-time settlement. This enhances the customer experience for end consumers.

Open banking payments, as a new way of paying, will offer greater choice to customers and merchants. This will bring more competition to card-based payments for e-commerce transactions.

-

Alternative Payment Methods

Alternative payment methods (APMs) are alternatives to global card payments.

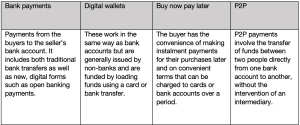

Open banking and new age rails are the driving force in the development of alternative payment methods. Over the next five years, usage of bank transfers, wallet payments, buy now pay later (BNPL), and person-to-person (P2P) payment methods schemes will grow significantly faster than payment cards.

Figure 13: Alternative Payment Methods

Did you know?

Bank transfers are 17% of UK and European ecommerce payments and are projected to grow 10% by 2026.

By offering APM to customers, businesses will give them control over their data, identity, and payments. This empowers customers and allows businesses to leverage large amounts of payment data generated by APM usage. APMs reduce payment transaction fees and provide customers with a personalised, frictionless experience.

-

Cloud

Financial institutions were once hesitant to deploy payment apps on cloud, but security and regulatory issues have since been addressed and many opt to have a cloud-first strategy. Central banks and regulators worldwide use cloud to drive inclusive and innovative payments transformation for instance

One advantage of cloud is that it enables a shift from a capital expenditure model to an operating expenditure model, as well as enabling businesses to scale up and down based on demand to control cost.

In a 2022 Volante/Finextra survey on payment modernisation, 69.5% of respondents deployed payment systems on the cloud. The report also showed a trend towards PAAS providers, accounting for most payment systems in 11.4% of respondents, up from 9% in the previous year. Additionally, 89.2% of new payment system implementations are expected to be on the cloud or with a PAAS provider.

Figure 14: Payments solutions and infrastructure on cloud survey – November 2022. Source: Volante/Finextra

Cloud-based infrastructure is crucial for real-time payment services, enabling transactions across regions with AI-based fraud detection at the network edge. As data and computation shift to the edge of the network, cloud services drive innovation. Businesses must leverage cloud infrastructure for payment services with the rise of 5G, machine learning, edge computing, and other network capabilities.

Summary

The payment industry has undergone significant moderisation in recent years, driven by various regulatory and infrastructure changes. The enablers of change have simplified, secured, and added flexibility to digital payments, leading to numerous benefits:

- New standards simplify, secure, and add flexibility to digital payments.

- Faster payment rails enable frictionless domestic and cross-border payments and value-added overlay services.

- Innovative payment methods improve customer experience and build loyalty.

- PSD2 grants third parties access to payments infrastructure and data to build innovative services with customer protections.

- Cloud adoption facilitates distributed and resilient payment infrastructure designs, accelerating the roll-out of new payment services into new markets.

Businesses must embrace these enablers to stay competitive, improve customer experiences, and capitalise on the opportunities presented by the evolving payment landscape.

Join us on our Banking, Financial Services, and Insurance page to explore our offerings and find out how GlobalLogic can help you.

More about the author:

Manik Jandial has over 22 years of experience in the software industry and specialises in new product development. He possesses a deep passion for leading product teams, guiding them from the ideation and discovery phase to the build and delivery phase.

Manik’s expertise extends across technology, program, and product management, enabling him to consistently deliver value-driven products for our customers. He has a diverse product development background spanning the telecom and B2C domains, with experience at organisations like Samsung R&D.

In recent years, he has concentrated on the payment domain, creating products and services for a prominent global technology payment organisation. His expertise includes real-time and card-based payment ecosystems, new payment methods, digital wallets, P2P and bill payment services, as well as ISO 20022 / ISO 8583 payment messages.

Prior to transitioning into product and program management, Manik gained extensive programming experience in languages such as C, C++, and Java. He holds a bachelor’s degree in engineering, a postgraduate certificate in General Management, and certifications like Project Management Professional (PMP) and ScrumMaster (CSM). Manik actively pursues continuous learning in product management, regularly participating in courses and staying updated with industry trends.